A freight index is a data average of weight for trucking, waterborne, freight rail, air freight, and pipeline. It is a measurement of aggregate deliveries of freight. Formed as data by the Bureau of Transportation Statistics Transportation Services Index (BTS TSI), the Cass Freight Index, and the Dow Transportation Index, the freight index is used to track the supply chain indicators.

For a freight rate index takes the sum of all freight data and calculates the average cost of transportation. Actively analyzing the data creates a transportation benchmark. This benchmark reflects the consistency and value of the data, pricing or demand, regardless of lane or market.

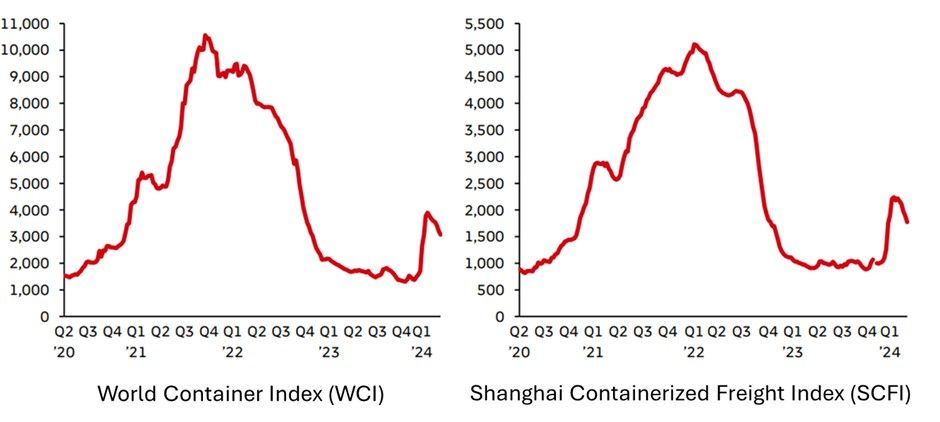

The World Container Index (WCI) is a global freight rate index that provides a weekly assessment of container freight rates on 11 major trade routes. It is used as a benchmark by shippers, carriers, and freight forwarders to monitor and compare rates across different routes and shipping lines. In Asia, the most popular indices are Shanghai Containerized Freight Index (SCFI) and China Containerized Freight Index (CCFI). Because China has been the largest exporter of goods in the world since 2009. Both are updated weekly and thus provides timely insights into fluctuations in container shipping costs for exports from Chinese ports. While the SCFI is based on spot rates from Shanghai to the ports in the index, the much broader China Containerized Freight Index (CCFI) is based on the price of containers leaving from all major ports in China, and is a composite of spot rates and contractual rates.

The CCFI and SCFI derives its rate estimates by polling panelists who include carriers, forwarders and shippers. In addition, the Drewry index is based on rates paid by freight forwarders to carriers. Please note that each of the major rateindexes measures a different slice of the overall market!

Here are also popular freight rate index.

- Xeneta Shipping Index

- Freight Baltic Index

- Tianjin Shipping IndexFar East Dry Bulk Index

- Southeast Asia Freight Index

- Taiwan Containerized Freight Index

At present, Chinese and foreign shipping companies with a large market share of the route provide the tariff information required for the preparation of freight Index, especially, SCFI and CCFI in accordance with the voluntary principle. They are: CMA-CGM, COSCO, EMC, HASCO, HEUNG-A, HLAG, HMM, HSDG, JINJIANG, KMTC, MAERSK, MSC, ONE, OOCL, PIL, RCL, SINOTRANS, SITC, TSL, WANHAI YANGMING, ZIM.

The idea that indexes can tell a shipper whether prices are rising or falling and, in turn, whether vessel capacity is tightening or becoming more abundant — has been a common theme in conversations with logistics managers responsible for ocean freight procurement.

Trends, not absolutes

The question for logistics managers becomes whether those rates reflect what NVOs are quoting today, or the preferential spot carriers might be offering to shippers with existing contracts, and freight indexes is that they do not compare real rates.