The Harmonized Commodity Description and Coding System generally referred to as "Harmonized System" or simply "HS" is a multipurpose international product nomenclature developed by the World Customs Organization (WCO).

Key features of HS codes:

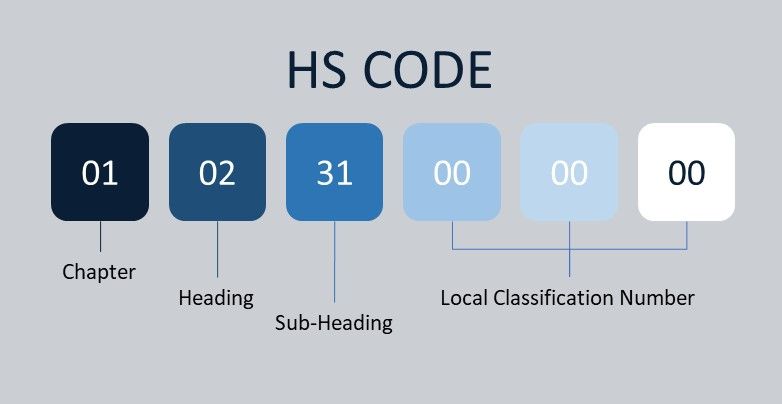

- 6-digit code to classify the goods

- Defined rules that classify the goods

- Act as a uniform standard for classification of goods worldwide

- Covers 98% of goods in international trade and over 5000 commodities

- The HS Committee also prepares amendments updating the HS every 5 – 6 years

It comprises more than 5,000 commodity groups, Singapore adopts the 8-digit HS Codes in the ASEAN Harmonised Tariff Nomenclature (AHTN), which is based on the WCO 6-digit level HS Codes, for use by all ASEAN Member States. And it's arranged in a legal and logical structure and is supported by well-defined rules to achieve uniform classification.

The system is used by more than 200 countries and economies as a basis for their Customs tariffs and for the collection of international trade statistics. Over 98 % of the merchandise in international trade is classified in terms of the HS.

Why you need your HS codes:

The correct HS code for your goods will be required for use in legal and commercial documents when undertaking trade, and are also used by customs authorities to apply tariffs and taxes to goods and keep track of imports and exports. The HS contributes to the harmonization of Customs and trade procedures, and the non-documentary trade data interchange in connection with such procedures, thus reducing the costs related to international trade.

It is also extensively used by governments, international organizations and the private sector for many other purposes such as internal taxes, trade policies, monitoring of controlled goods, rules of origin, freight tariffs, transport statistics, price monitoring, quota controls, compilation of national accounts, and economic research and analysis. The HS is thus a universal economic language and code for goods, and an indispensable tool for international trade.

Structure of the Harmonised System (HS)

The HS comprises 21 Sections covering 97 Chapters. It consists of:

- Section and Chapter titles describe broad categories of goods, while headings and subheadings describe products in more detail.

- General Interpretative Rules (GIR)

- Local Classification Number – National Tariff Line (7-12 digits), items depending on the country (also referred to as commodity codes and national tariff lines

HAKOVO’s Smartariff an automated AI solution

In the market, there is a free Search tool to find the tariff code to correctly classify your goods for customs. HAKOVO AI platform - Smartariff lets you automatically categorize products and recommends HS code based on the description.

Tariff Clarification

Powered by machine learning algorithms and Natural Language Processing (NLP), our Smartariff’s search engine automates the process of identifying HS codes based on product descriptions.

AI Predictions

Data is pulled from a supervised data source and analysed by our AI before being stored. HAKOVO’s Smartariff provides predictions and recommendations through a model that learns from the textual descriptions of products.

Multi-Country Coverage

The system offers HS code recommendations for diverse countries and is able to accommodate specific regional requirements.

Bulk HS Code Recommendations

Bulk upload (CSV file) capabilities help speed up your classification process.