The Trump tariffs continue to have a significant impact on global trade. In particular, developments in shipping companies and maritime container trends for shipments from China to the United States warrant closer examination. Amid a sharp decline in bookings on this trade route, shipping lines are not only skipping more Far East–North America voyages but are also withdrawing entire Transpacific service loops.

Chinese carriers COSCO SHIPPING Lines and OOCL have decided to close their joint Far East–West Coast North America loop, SEA3 / PSX, while MSC has ceased announcing further sailings for its standalone Far East–US West Coast service, Orient. These moves come in response to weakened cargo demand, as Chinese goods arriving at US ports now face levies of up to 145%.

The Port of Los Angeles reports a 35% decline in imports this week compared to the same period last year, while the Port of Long Beach anticipates a 30% drop in imports for the entire month. Long Beach is not only experiencing a surge in blank sailings but is also losing two service loops. The final call for the COSCO / OOCL SEA3 / PSX loop took place on Wednesday, 7 May, with the 8,888 TEU OOCL UTAH.

Meanwhile, ONE has announced a new call at Felixstowe for its Premier Alliance Far East–Europe FE4 service, making the UK port the first European stop on the loop from Asia. The 23,792 TEU HMM SOUTHAMPTON will mark the loop’s maiden call at Felixstowe on 9 July, following an updated rotation that includes Shanghai, Ningbo, Kaohsiung, Yantian, Cai Mep, Singapore, Felixstowe, Rotterdam, Hamburg, Le Havre, Algeciras, Singapore, Kaohsiung, and Shanghai. This service, operated by ONE, HMM, and Yang Ming, deploys 14 ships ranging from 14,700 to 24,100 TEU and will be the only East–West loop of the alliance to call at a British port. As part of its VSA agreement with the Premier Alliance, MSC is participating under its Silk branding.

Meanwhile, Vietnam’s trade activity has reached post-pandemic record levels, with imports from China and exports to the US surging. Discussions between Washington and Hanoi are ongoing regarding Vietnam’s trade surplus, alongside a crackdown on Chinese goods rerouted via Vietnam to the US.

Vietnam’s Cai Mep deep-sea port, which handles most of the country’s maritime exports to the US, is experiencing a surge in shipments, according to a vice president at SSA Marine, which operates a terminal in Cai Mep. The port, which hosts all major shipping companies, has scheduled 26 container ships for weekly US-bound departures in May, an all-time high compared to its usual 20–22 departures. Most container terminals are now operating at full or near-full capacity, reflecting anticipation of higher tariffs.

At US borders, mis-declared shipments are causing delays, with entire truckloads being rejected due to a single non-compliant item. Under US trade regulations, shipments must undergo substantial transformation—a process that adds real value—before they can legally claim a new country of origin.

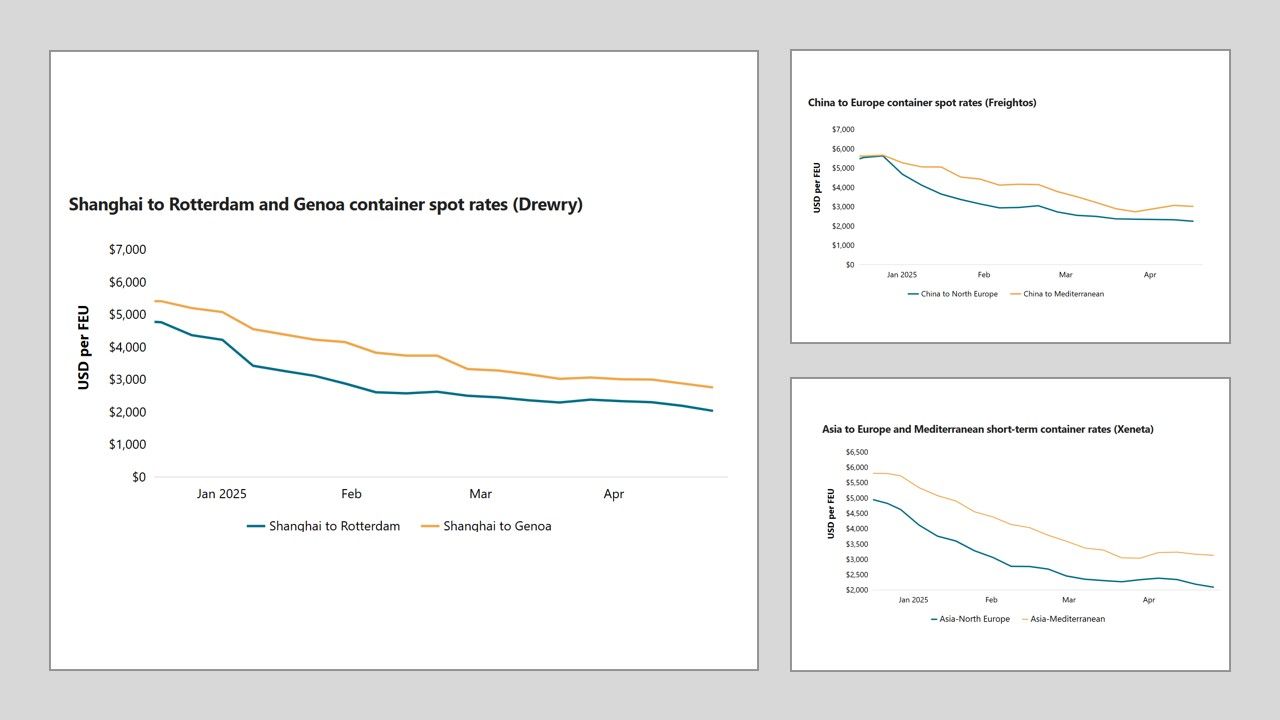

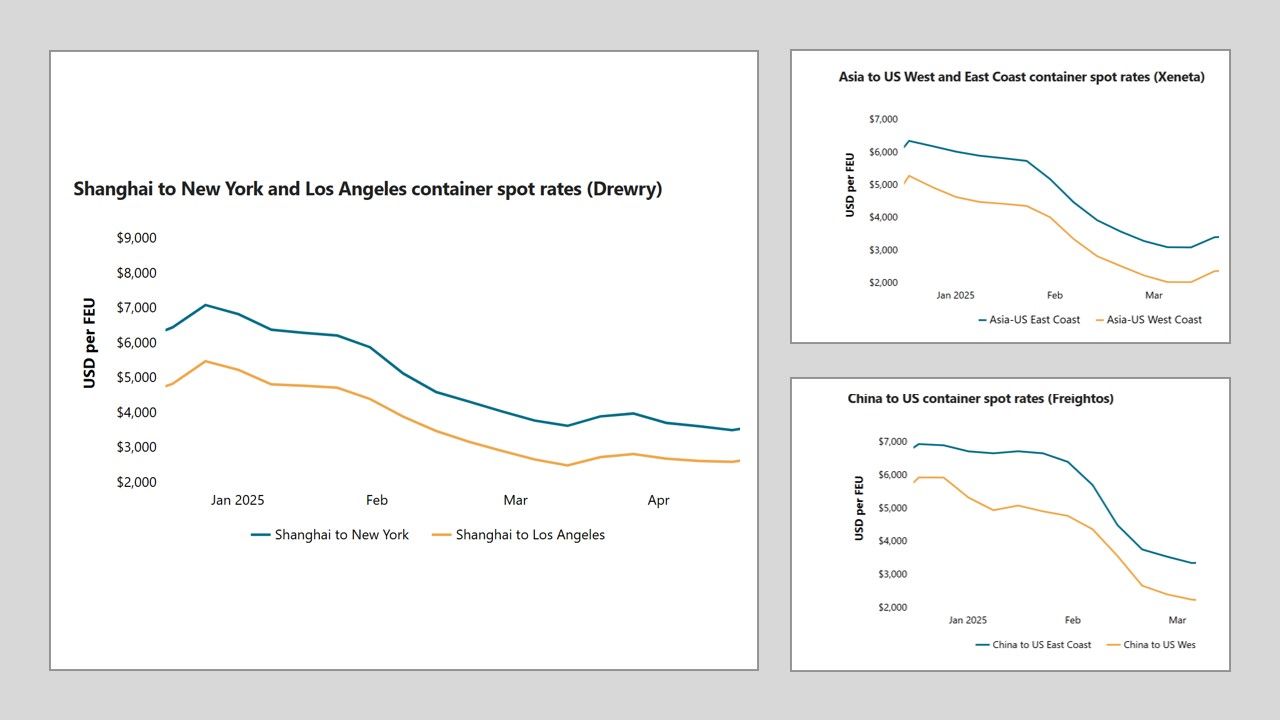

Ocean Rates (Drewry's, Xeneta, Freightos) for comparison purposes only to SCFI weekly report.

Asia to North America

Asia to Europe