Singapore is a major global hub for shipping and logistics, and its ports are among the busiest in the world. However, the city-state's ports are also facing growing congestion as trade continues to increase. The Port of Singapore, in particular, is experiencing delays and bottlenecks, leading to disruptions in supply chains for businesses.

Container volumes handled in Singapore from January to April 2024 came to about 13.4 million 20-foot-equivalent-units (TEUs), up 8.8 per cent year on year. Currently, Port Congestion in Singapore has forced some liners to skip the world’s top transshipment hub, as delays in the city-state have reached” critical levels” of up to seven days.The congestion is so bad that ships of up to 450,000 teu are queuing to berth, and the analysts estimate the queue time to be up to seven days.

Carriers are extending charter agreements and ordering new containers in preparation for a potentially prolonged peak season. Currently, 6.8% of the global fleet is impacted, with Singapore becoming a major congestion hotspot.

In response to this severe congestion, some carriers have omitted planned calls at Singapore, shifting the burden to downstream ports that will need to manage additional volumes. This has led to vessel bunching, spillover congestion, and schedule disruptions at these ports.

The SCFI [Shanghai Containerized Freight Index] has jumped by 42% in the past month, with further gains to follow in June as carriers are adding new surcharges and rate hikes,” stated Linerlytica in its latest weekly report.

As a result of the raised congestion levels vessel operators have been forced to take action to secure their peak season positions, “after their initial hesitation to commit too far ahead if demand would falter after the summer peak season,” argued Linerlytica.

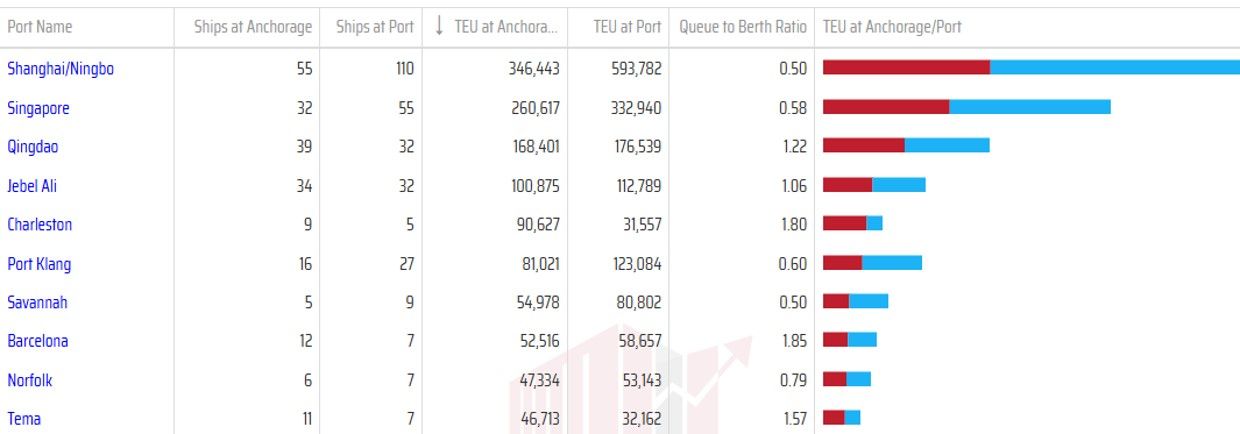

Top 10 Global Containership Port Congestion as of End of May 2024

Source: linerlytica.com

Market signals are “extremely bullish” and are reminiscent of the substantial rate increases that began in 2021 and continued throughout 2022, as the pandemic effects reached their heights.

During the pandemic-affected period supply chain congestion was caused by inland connections and a lack of storage in the US ports and inland terminals, causing ships to be delayed waiting for cargo handling slots, with the knock-on effect that too few empty containers were being returned to Asia for loading.

This year congestion has returned to container supply chains, with Singapore becoming the latest victim, as ships are returning to Asia out of schedule due to extended journeys around the African Cape and the blanked sailings when vessels were unavailable to meet weekly schedules.

Linerlytica added, “The severe congestion has forced some carriers to omit their planned Singapore port calls, which will exacerbate the problem at downstream ports that will have to handle additional volumes.”

These delays have resulted in vessel bunching, causing “spillover congestion” and schedule disruptions at downstream ports.

Increasing port congestion has already taken more than 400,000 TEUs of vessel capacity out of circulation in the last week alone with a further escalation to the current critical delays expected in the coming weeks as the peak season gathers pace.